https://shopthru.com/wp-content/uploads/2026/02/ACEL.png

400

665

Matt Parkinson

https://shopthru.com/wp-content/uploads/2025/05/shopthru-logo-colour.png

Matt Parkinson2026-02-24 09:58:002026-02-24 10:00:50ACEL: The Missing Execution Layer in Agentic Commerce

https://shopthru.com/wp-content/uploads/2026/02/ACEL.png

400

665

Matt Parkinson

https://shopthru.com/wp-content/uploads/2025/05/shopthru-logo-colour.png

Matt Parkinson2026-02-24 09:58:002026-02-24 10:00:50ACEL: The Missing Execution Layer in Agentic CommerceWhy UK Retail Must Catch Up with Consumer Expectations

Read time: 10 mins

Mobile Has Won – But Checkout Hasn’t Caught Up

71% of UK ecommerce traffic now comes from mobile devices. Yet cart abandonment is still stubbornly high, and mobile conversion rates continue to lag behind desktop. Why? Because most retailers are still forcing mobile shoppers through outdated, friction-filled checkout processes that don’t reflect how consumers live – or expect to shop.

We’ve entered the age of agentic commerce – where consumers move seamlessly from inspiration to transaction. But for many UK retailers, the path from product discovery to purchase is still paved with friction.

Study Findings: Retailers Are Lagging Behind

We conducted a comprehensive analysis of the UK’s top 250 ecommerce retailers. Here’s what we found:

- 70% of retailers don’t offer any checkoutless options – no payment method prior to the standard checkout.

- 86% offer PayPal, but only 29% use PayPal Express correctly (on the product or basket page).

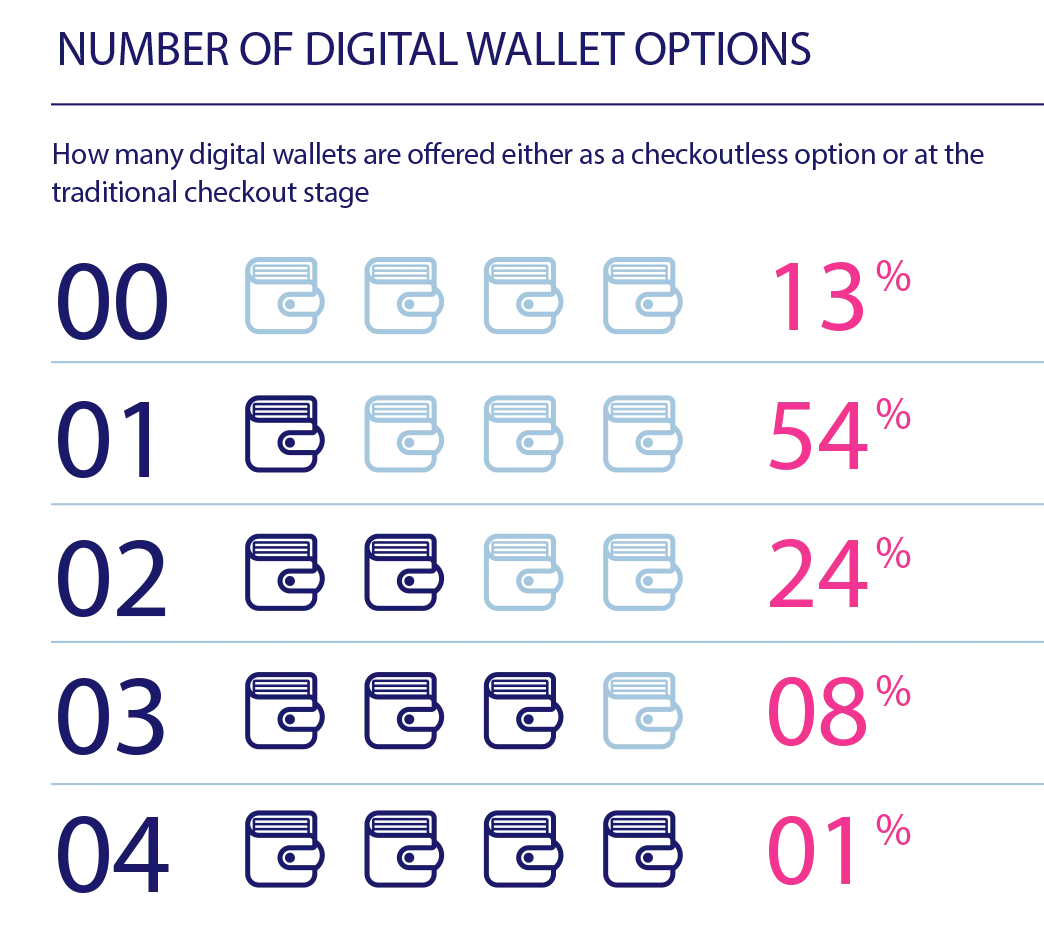

- Only 1 out of 250 retailers offered all four major wallets: PayPal, Amazon Pay, Apple Pay, and Google Pay.

- 13% of retailers offer no digital wallet at all.

“Despite high mobile traffic, most retailers still treat checkout like it’s 2015 – long forms, multiple steps, and lost sales.”

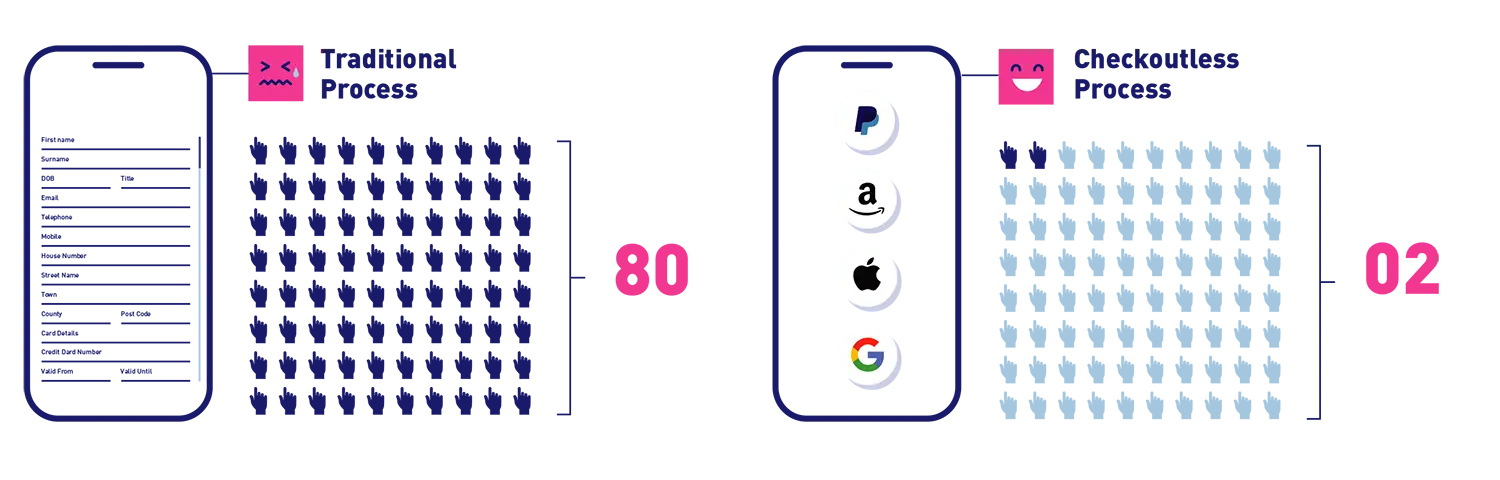

Friction vs. Expectation

Today’s mobile consumers expect buying to be as fast and seamless as ordering a ride or booking a table. They’re used to one-tap experiences. Anything slower – or less intuitive – increases abandonment risk.

The gap between expectation and reality is costing retailers millions in lost revenue.

Checking Out Who’s Checkoutless, and Why It Matters

Our research revealed that checkoutless commerce is yet to become mainstream in the UK, with over two-thirds of retailers (70 percent) failing to offer any means of paying for a purchase before the conventional checkout stage.

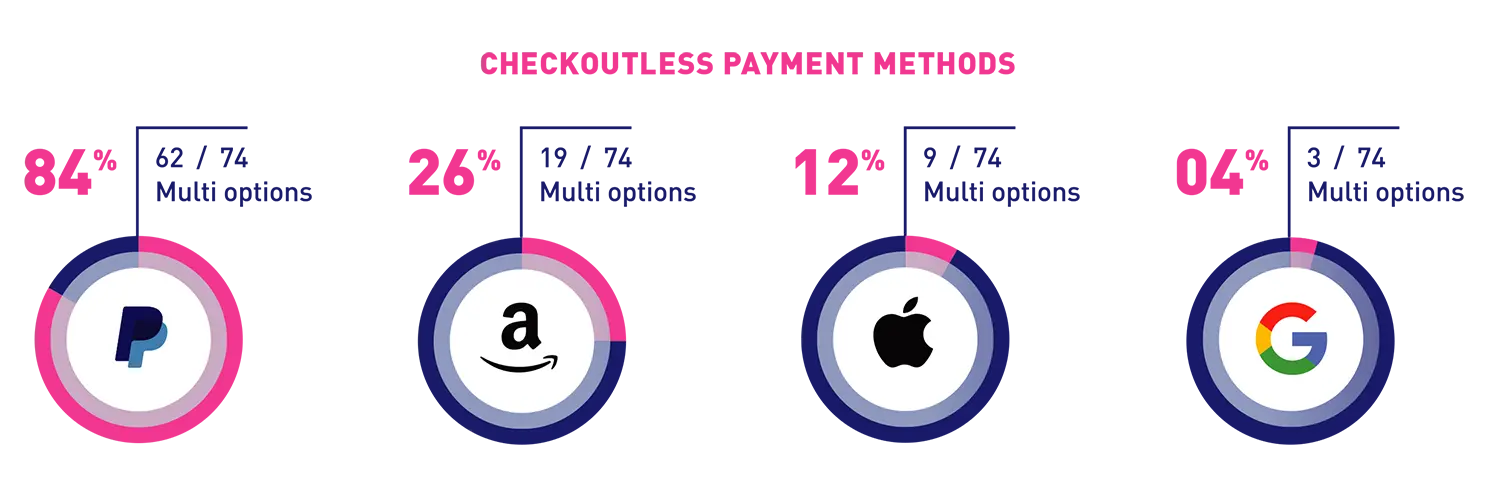

Of those brands that do provide checkoutless payment methods, the most popular is PayPal Express which is offered by 84 percent. This high level of integration is revealing, if not surprising. Merchants may choose to provide PayPal Express as they know it enables conversion and consumers feel confident with a familiar, trusted brand that operates a simple redress service. The same rationale could apply to the popularity of Amazon Pay, which is offered by 26 percent of retailers.

We also found that Apple Pay and Google Pay have not yet been widely adopted. Offering a device-specific wallet would seem a good way to connect with specific market segments. However, some banks have been slow to integrate the technology, which is reflected in the low take-up.

Digging Deeper into Digital Wallet Use

When we examined the availability of the four major digital wallets at any stage of the payment process, we again found PayPal to be the most popular, offered by 86 percent of the 250 retailers studied. Despite its extensive deployment, only 29 percent were using PayPal’s Express function correctly, on the product or basket page. This implies a possible lack of understanding of its functionality as a checkoutless payment method.

We also observed the number of digital wallets provided, either as a checkoutless option or at the traditional checkout stage. Over half the brands (54 percent) had just one wallet, while just under a quarter (24 percent) offered two. Only one retailer provided all four options, and 33 offered none.

Ideally, they should offer a selection. If retailers are concerned that the basket page will be overrun with logos, they can set up processes that remember how a customer likes to transact, then personalize payment options accordingly.

Why Retailers Resist Change

Several factors hold back adoption:

- Legacy systems that aren’t built for embedded checkout.

- IT priorities often focused on design over performance.

- Perceived risk in adjusting payment flows.

- Misunderstanding about how and where wallets can be deployed.

Yet the opportunity is clear: reduce clicks, reduce form fields, and let the shopper pay when they’re ready.

Mobilise the Opportunity

Convenience is the new commodity online and checkoutless commerce is an integral part of this. The retail industry can be transformed by embracing technology that makes life more convenient for customers but requires a different psychology. Paying for purchases using a phone or watch is a nascent development and one which retailers and consumers are still adjusting to.

There are always competing IT priorities—investing in the look and feel of an online store will usually take precedence over innovative checkout solutions—and changing payment gateways is relatively high risk. Businesses need payment solutions that integrate seamlessly into their mobile storefronts, so a mindset shift at the web design stage is necessary to integrate digital wallet options in an optimal way rather than layering new software over legacy processes and payment systems which slow down a site’s responsive capabilities.

Traditional online checkouts will become redundant as technology enabling merchants to interface directly with devices for payment advances. Checkoutless commerce is just the start of the mobile payment revolution

The Future of Checkout

Traditional checkout pages are becoming obsolete. Embedded, context-aware payment is the future – and it’s already here.

Retailers who align with consumer behavior will win. Those who resist change will keep losing high-intent customers at the last hurdle.

Shopthru helps brands close that gap – by meeting shoppers where they are, at the moment they’re ready to buy.